Guide to Residential Elevators

Planning for a home elevator installation

Buying an elevator for your home can be a straightforward process with the right planning and information. Home elevators are available in many different types and styles, and the best place to start is by learning about the various designs. The following guide has useful information about the most common types of elevators, including hydraulic, machine room-less, winding drum, shaftless, and vacuum.

This guide provides a general overview of:

- Residential elevator systems

- The best type to use for specific applications

- Typical installation requirements

- Top home elevator brands and manufacturers

Tip: Always check with your local code authority and elevator contractor when planning an installation. Elevator codes can vary in different locations and while most are uniform some jurisdictions may have special requirements.

Hydraulic Elevators

Hydraulic elevators are heavy-duty home elevators. They have a standard weight capacity of 750 lbs. and can even carry up to 1000 lbs. This type of elevator will require a full hoist-way enclosure on every floor, a pit at the lowest landing, and a separate machine room. Hydraulic elevators operate with a hydraulic piston to raise and lower the cab. This type of elevator offers a very smooth and quiet ride quality.

If you need an elevator that will require heavy use and carry a higher weight capacity, hydraulic is a great option. With a design that has been in use for over 50 years, the hydraulic elevator has proven its use and reliability in the residential elevator market. READ MORE >>>

Machine Room-Less

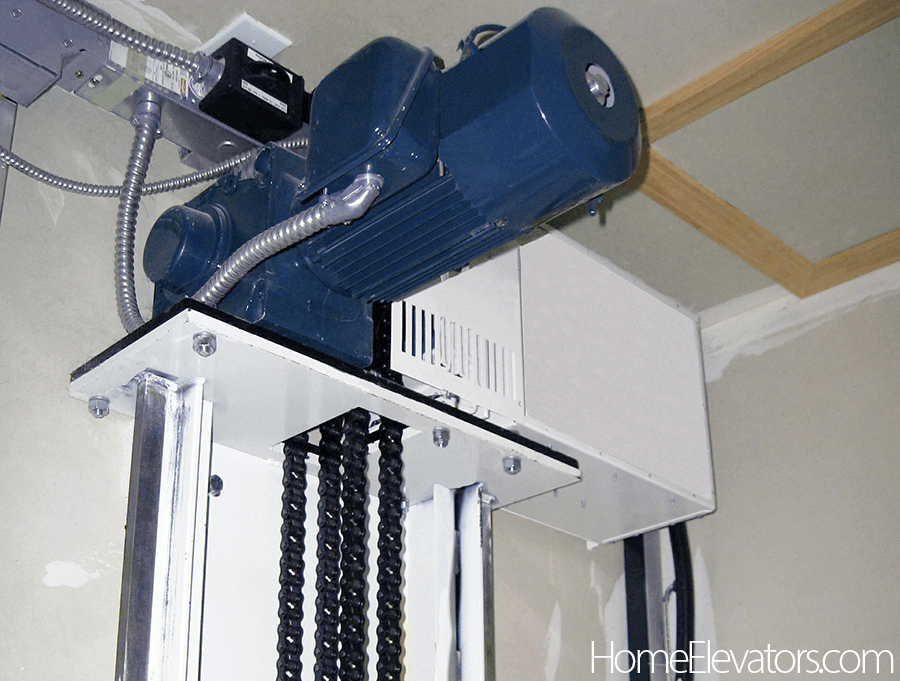

Machine room-less elevators are also referred to as MRL. With an MRL elevator, the drive and controller are located in the hoistway eliminating the need for a separate machine room. This can be ideal if you don’t have the space for a machine room but still want a larger cab that can serve up to 5 landings. MRL’S are available in counterweight electric chain drive and cable drive systems. READ MORE >>>

Winding Drum Elevators

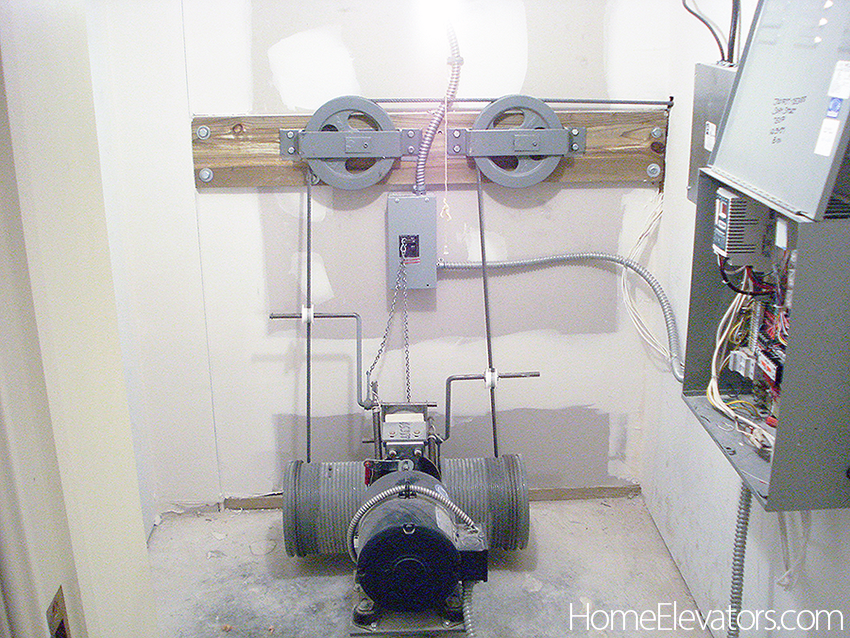

Winding drum elevators operate with an electric motor to wind the cable on a drum that will raise and lower the elevator. This type of elevator requires a hoistway, pit, and machine room. Winding drum elevators will typically have a 500-750lb. capacity. The ride quality is standard.

This type of elevator is available in a variety of configurations with the placement of the motor assembly. Here the drive is located in a separate machine room. The machine room is always recommended for ease of service and maintenance if the space is available. READ MORE >>>

Shaftless Elevators

The shaft-less elevator also referred to as a through-floor elevator or lift is made to serve two floors. This type of elevator can retrofit easily into existing homes and requires the least amount of space compared to traditional elevators. Construction is also kept to a minimum without the need for a full hoist-way enclosure, pit, and separate machine room.

Shaft-less elevators are available from several different manufacturers with variations in cab styles, mechanical designs, and installation requirements. Some models can be placed almost anywhere in a home making the process of installing an elevator much easier.

This elevator is made for convenience, limited space, and simplicity. They are lifestyle lifts designed to help with mobility and are a great alternative to a stairlift or full-style traditional elevator. READ MORE >>>

Vacuum Elevators

Vacuum elevators are air-driven elevators that use air pressure to raise and lower the cab. They are available in three models the PVE30, PVE37, and PVE52. The number in the model represents the external size of the cylinder. The PVE30 has a 30″ cylinder and fits one person. This model has the smallest footprint of any home elevator on the market. The PVE37 is the original vacuum elevator model and can carry two riders with a 450lb capacity. The largest model the PVE52 has a cylinder diameter of 52-11/16 inches can carry three riders with a 525 lb capacity and is wheelchair accessible.

Similar to the shaft-less elevator the vacuum elevator is great for limited space applications. The construction is kept to a minimum and the lifts also don’t require a pit or machine room. Vacuum elevators can serve up to 5 landings with 50′ of max travel.

The Best Home Elevators

Currently, some of the best residential elevators are built by Custom Elevator Manufacturing, Inc., SAVARIA, Symmetry, and Pneumatic Vacuum Elevators, LLC. The most suitable elevator for your home will be the one that fits your needs, budget, site conditions, and floor plan. When considering these factors there are two main categories to choose from, elevator type and manufacturer. Of course, there’s cost and we’ve written about elevator pricing here to give you a general idea of the budget and related expenses. Since we’ve been in the elevator business and have a real working knowledge of elevator systems we’ve provided this list of top elevator companies for each type of installation, manufacturer information, and brand or model.

Elevator Type and Application Guide

| Elevator Type | Best Application | Model | Top Brands |

|---|---|---|---|

| Hydraulic Elevator | Heavy use, high weight capacity, up to 5 floors | IR-1 Signature series | Custom Elevator Manufacturing, Inc. |

| Machine room-less (MRL) Elevator | Waterfront installations and limited space over 2 floors | Inline Gear Drive | Symmetry |

| Glass Elevator | High-end luxury style, free standing structure, 360 views | Vuelift Octagonal & Round | Vuelift |

| Shaftless Elevator Lift | Retro-fit, affordable, medical conditions, retirement living & aging in place, 2 -floors | Telecab | SAVARIA |

| Vacuum Elevator | Space saving, stand-alone unit with modern look | PVE-30 | Pneumatic Vacuum Elevators, LLC |